Zero Cost Collar Rates . This results in no net cost to establish the collar but may require selecting strike prices further away from the current market price of the underlying asset. It does this by utilising call and. You'll find the closing price, open, high, low, change and. a zero cost collar is an options strategy that allows you to lock in a range for a stock’s price without paying any net premium. Depending on the term length of the option, any gains may be taxed at your ordinary income rate.

from aegis-hedging.com

It does this by utilising call and. You'll find the closing price, open, high, low, change and. This results in no net cost to establish the collar but may require selecting strike prices further away from the current market price of the underlying asset. a zero cost collar is an options strategy that allows you to lock in a range for a stock’s price without paying any net premium. Depending on the term length of the option, any gains may be taxed at your ordinary income rate.

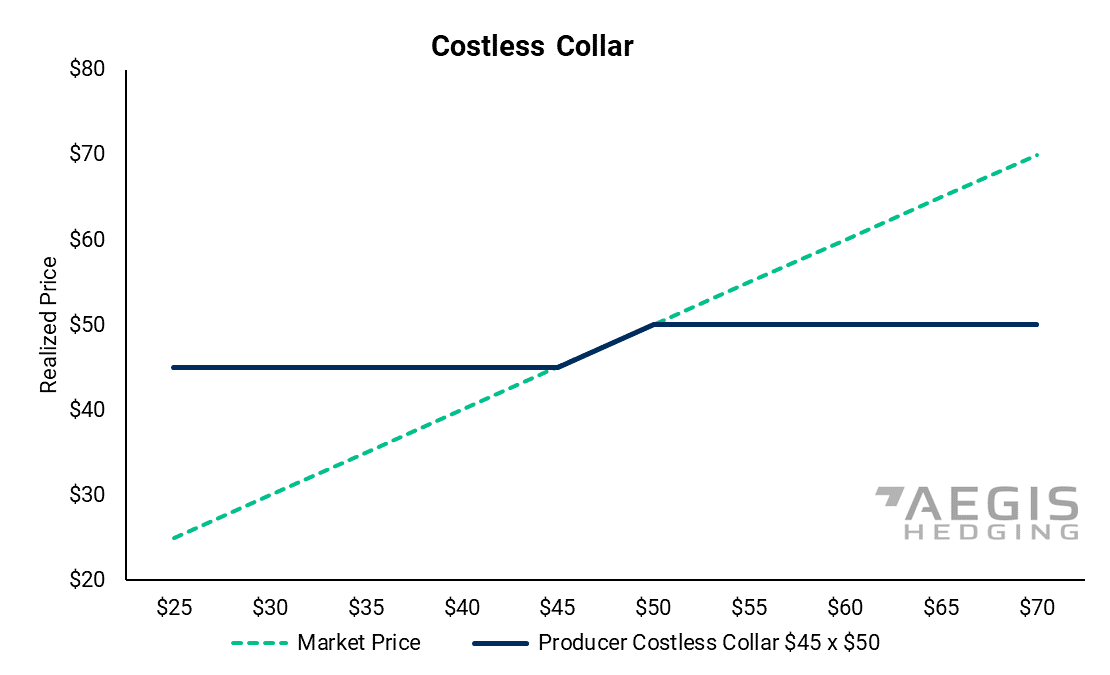

Hedging Strategy Toolkit Bull Market Aegis Market Insights

Zero Cost Collar Rates a zero cost collar is an options strategy that allows you to lock in a range for a stock’s price without paying any net premium. a zero cost collar is an options strategy that allows you to lock in a range for a stock’s price without paying any net premium. Depending on the term length of the option, any gains may be taxed at your ordinary income rate. It does this by utilising call and. You'll find the closing price, open, high, low, change and. This results in no net cost to establish the collar but may require selecting strike prices further away from the current market price of the underlying asset.

From www.moneybestpal.com

ZeroCost Collar Zero Cost Collar Rates This results in no net cost to establish the collar but may require selecting strike prices further away from the current market price of the underlying asset. It does this by utilising call and. a zero cost collar is an options strategy that allows you to lock in a range for a stock’s price without paying any net premium.. Zero Cost Collar Rates.

From aegis-hedging.com

Hedging Strategy Toolkit Bull Market Aegis Market Insights Zero Cost Collar Rates It does this by utilising call and. This results in no net cost to establish the collar but may require selecting strike prices further away from the current market price of the underlying asset. Depending on the term length of the option, any gains may be taxed at your ordinary income rate. a zero cost collar is an options. Zero Cost Collar Rates.

From www.fastmarkets.com

Commodity trading A guide to hedging, futures contracts and zerocost Zero Cost Collar Rates a zero cost collar is an options strategy that allows you to lock in a range for a stock’s price without paying any net premium. Depending on the term length of the option, any gains may be taxed at your ordinary income rate. You'll find the closing price, open, high, low, change and. This results in no net cost. Zero Cost Collar Rates.

From slashtraders.com

Unlock ZeroCost Collar to Hedge Your Stocks for Free SlashTraders Zero Cost Collar Rates You'll find the closing price, open, high, low, change and. a zero cost collar is an options strategy that allows you to lock in a range for a stock’s price without paying any net premium. Depending on the term length of the option, any gains may be taxed at your ordinary income rate. This results in no net cost. Zero Cost Collar Rates.

From www.ig.com

Zero Cost Collar Strategy A Complete Trading Guide IG International Zero Cost Collar Rates Depending on the term length of the option, any gains may be taxed at your ordinary income rate. You'll find the closing price, open, high, low, change and. a zero cost collar is an options strategy that allows you to lock in a range for a stock’s price without paying any net premium. It does this by utilising call. Zero Cost Collar Rates.

From estably.com

Collar Optionsstrategie einfach erklärt Zero Cost Collar Rates You'll find the closing price, open, high, low, change and. It does this by utilising call and. Depending on the term length of the option, any gains may be taxed at your ordinary income rate. a zero cost collar is an options strategy that allows you to lock in a range for a stock’s price without paying any net. Zero Cost Collar Rates.

From savantwealth.com

The ZeroCost Collar A Strategy to Limit Your Losses…and Gains Zero Cost Collar Rates Depending on the term length of the option, any gains may be taxed at your ordinary income rate. It does this by utilising call and. a zero cost collar is an options strategy that allows you to lock in a range for a stock’s price without paying any net premium. This results in no net cost to establish the. Zero Cost Collar Rates.

From www.juststartinvesting.com

Zero Cost Collar Strategy Explained Just Start Investing Zero Cost Collar Rates This results in no net cost to establish the collar but may require selecting strike prices further away from the current market price of the underlying asset. Depending on the term length of the option, any gains may be taxed at your ordinary income rate. a zero cost collar is an options strategy that allows you to lock in. Zero Cost Collar Rates.

From www.lynxbroker.de

Der Zero Cost Collar Optionsstrategien Online Broker LYNX Zero Cost Collar Rates It does this by utilising call and. You'll find the closing price, open, high, low, change and. This results in no net cost to establish the collar but may require selecting strike prices further away from the current market price of the underlying asset. a zero cost collar is an options strategy that allows you to lock in a. Zero Cost Collar Rates.

From financetrain.com

How Interest Rate Collars Work? Finance Train Zero Cost Collar Rates a zero cost collar is an options strategy that allows you to lock in a range for a stock’s price without paying any net premium. It does this by utilising call and. You'll find the closing price, open, high, low, change and. This results in no net cost to establish the collar but may require selecting strike prices further. Zero Cost Collar Rates.

From www.awesomefintech.com

Zero Cost Collar AwesomeFinTech Blog Zero Cost Collar Rates This results in no net cost to establish the collar but may require selecting strike prices further away from the current market price of the underlying asset. a zero cost collar is an options strategy that allows you to lock in a range for a stock’s price without paying any net premium. Depending on the term length of the. Zero Cost Collar Rates.

From www.stockgro.club

How zerocost collar can save losses in a trading strategy Zero Cost Collar Rates Depending on the term length of the option, any gains may be taxed at your ordinary income rate. It does this by utilising call and. You'll find the closing price, open, high, low, change and. This results in no net cost to establish the collar but may require selecting strike prices further away from the current market price of the. Zero Cost Collar Rates.

From www.youtube.com

What is Zero Cost Collar trading strategy? YouTube Zero Cost Collar Rates This results in no net cost to establish the collar but may require selecting strike prices further away from the current market price of the underlying asset. Depending on the term length of the option, any gains may be taxed at your ordinary income rate. It does this by utilising call and. You'll find the closing price, open, high, low,. Zero Cost Collar Rates.

From dxostrjgy.blob.core.windows.net

Zero Cost Collar Excel at Patricia Timmons blog Zero Cost Collar Rates This results in no net cost to establish the collar but may require selecting strike prices further away from the current market price of the underlying asset. It does this by utilising call and. Depending on the term length of the option, any gains may be taxed at your ordinary income rate. a zero cost collar is an options. Zero Cost Collar Rates.

From www.juststartinvesting.com

Zero Cost Collar Strategy Explained Just Start Investing Zero Cost Collar Rates a zero cost collar is an options strategy that allows you to lock in a range for a stock’s price without paying any net premium. You'll find the closing price, open, high, low, change and. It does this by utilising call and. This results in no net cost to establish the collar but may require selecting strike prices further. Zero Cost Collar Rates.

From www.stockgro.club

How zerocost collar can save losses in a trading strategy Zero Cost Collar Rates It does this by utilising call and. a zero cost collar is an options strategy that allows you to lock in a range for a stock’s price without paying any net premium. Depending on the term length of the option, any gains may be taxed at your ordinary income rate. This results in no net cost to establish the. Zero Cost Collar Rates.

From www.deltavalue.de

Zero Cost Collar Optionsstrategie DeltaValue Zero Cost Collar Rates It does this by utilising call and. You'll find the closing price, open, high, low, change and. a zero cost collar is an options strategy that allows you to lock in a range for a stock’s price without paying any net premium. Depending on the term length of the option, any gains may be taxed at your ordinary income. Zero Cost Collar Rates.

From slashtraders.com

Unlock ZeroCost Collar to Hedge Your Stocks for Free SlashTraders Zero Cost Collar Rates a zero cost collar is an options strategy that allows you to lock in a range for a stock’s price without paying any net premium. Depending on the term length of the option, any gains may be taxed at your ordinary income rate. You'll find the closing price, open, high, low, change and. This results in no net cost. Zero Cost Collar Rates.